With the advent of technologies like quantum encryption, what should we expect from the future of our financial transactions?

Digital advances have changed our financial experience. With the advent of technologies such as quantum encryption as well as decentralized finance, what should we expect from the future of our financial transactions.

What’s happening?

- Mobile banking apps, investment apps and the digitization of financial markets have made it easier than ever to access financial services.

- The integration of 5G, Internet of Things (IoT), Artificial Intelligence (AI), Augmented Reality/Virtual Reality (AR/VR) will bring digital and physical operations together. Distributed ledger technology (DLT) will speed up transactions. Quantum computing will strengthen basic financial processes.

- To compensate for the digital shift, it is recommended to occasionally use cash, own gold investments or build relationships with advisors.

A brief history of financial technology

Financial technologies (“fintech”) have transformed global finance from the late 19th century to the present day. It all started with the development of infrastructure for digital transfers of funds using the telegraph and Morse code. The introduction of the ATM in 1967 marked a shift to digitization with subsequent innovations including Nasdaq, the first digital stock exchange, online banking and the introduction of PayPal.

After the 2008 recession, trust in traditional banks declined dramatically, spurring innovation in finance. Bitcoin was born soon after as a decentralized way of conducting transactions completely independent of conventional banks. At the same time, banking services available on our mobile phones appeared.

Startups started popping up everywhere, creating revolutionary products available digitally rather than physically, and using open banking systems to securely connect user data with third-party providers. This made it possible to create personalized financial solutions for each user.

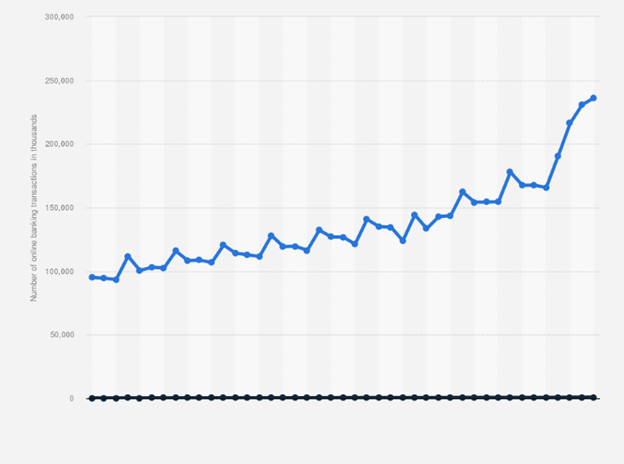

Total number of online banking transactions in Switzerland (2012-2022)

Source: Extra

“Neo-banks” like FlowBank are a new type of digital financial institution created using technology. They don’t have physical branches, which makes them easier to create and maintain. Because they rely heavily on technology, consumers have faster access to their funds, can more easily customize their accounts, and have access to everything at a lower cost than traditional banks. They also likely offer higher interest rates on savings accounts, which is one of the reasons people have been looking for an alternative to traditional banks.

New technologies in financial services

The next era of finance is expected to be revolutionary and technology will play a vital role in shaping services and setting new standards.

With the advent of artificial intelligence (AI) and machine learning, financial services are poised for a major shift towards personalization. These technologies make it possible to analyze large data sets and provide personalized recommendations and advice to meet individual financial goals and preferences.

Furthermore, as cyber threats become increasingly sophisticated, the need for robust security measures is paramount. Quantum encryption is emerging as a promising solution that offers a level of security that could be virtually unbreakable, thereby more effectively protecting financial data from cyberattacks.

Decentralized Finance (DeFi) represents another major shift that uses blockchain and Distributed Ledger Technology (DLT) to facilitate financial transactions without relying on traditional intermediaries such as banks. This conceptual shift promises to make financial services more accessible and egalitarian, potentially changing the way people approach their finances.

The largest fintech stocks by market capitalization

- PayPal Holdings, Inc. (PYPL) – Digital payments industry dominant player PayPal has expanded its offering to include payment processing for consumers and merchants. Peer-to-peer transfers and mobile payments are made through the Venmo platform.

- Square, Inc. (now Block, Inc. – SQ) – Specializing in financial and payment services for individuals and businesses, Square has diversified its services to include point-of-sale solutions, small business financing, but also developed the Cash app for personal finance.

- Adyen (ADYEN) – A global payments company that offers businesses of all sizes a platform to accept payments, process transactions and use analytics to drive operations.

- Intuit Inc. (INTU) – Known for products like TurboTax, QuickBooks and Mint, Intuit offers financial, accounting and tax software for individuals and small businesses.

- Fidelity National Information Services (FIS) – Provides banking and payment technologies to financial institutions and businesses worldwide.

- Global Payments Inc (GPN) – Offers payment technologies and software solutions for card, check or digital payments.

- Affirm Holdings, Inc. (AFRM) – Another “buy now, pay later” service that offers consumers a flexible option to pay for online purchases – without deferred interest or hidden fees – but rather with transparent financing terms that clearly show the amount owed each month for the life of the loan.

Analog backup for technology

Despite these technological advances, some traditional financial practices are not going away anytime soon. The tangibility, privacy and security of using cash or investing in physical assets such as gold, real estate, fine art or antiques should not be neglected in the digital age. These assets provide much-needed diversification to your portfolio and allow you to not rely solely on digital infrastructure.

Likewise, the personal touch provided by financial advisors remains invaluable to those seeking tailored financial advice, highlighting the need for a balanced approach that respects both the effectiveness of digital trends and the certainty of human interaction.

in total

Fintech developments have already reshaped finance, with mobile banking and digital advances providing unprecedented convenience. The future promises even more radical changes, from personalization to AI to increased security through quantum encryption to the rise of decentralized finance (DeFi).